By Gabriel Seder, Destinations International Foundation

Six months into the Covid-19 pandemic, the state of the hotel industry is bleak. This according to a new report published last week by the American Hotel and Lodging Association (AHLA) under the headline “Hotel Industry Remains on Brink of Collapse.”

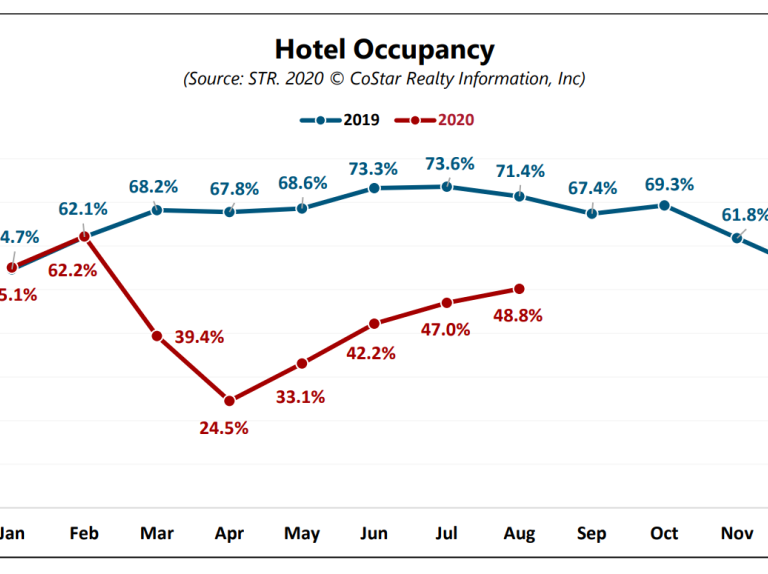

The report, based on STR data, AHLA research and public data, concludes that hotel occupancy rates in the US remain unsustainably low. Hotels in urban areas are particularly hard hit, with an average occupancy rate of just 38%. The pain is not limited to specific regions of the country; hotels in nearly every urban market report cripplingly low occupancy. Despite a steady climb through the summer from a low of 24% in April, nearly two-thirds of properties report occupancy rates below 50%, the typical break-even point for an industry with high overhead costs and heavy debt loads.

The low occupancy rate is driven by the staggering year-over-year decline in consumer travel. AHLA cites a report that finds only 33% of consumers have traveled for leisure since March. Compare this to a normal year, when approximately 70% of Americans will take a least one leisure trip. Despite the reduced numbers, leisure travel has accounted for the majority of occupancy for most properties because group and business travel has become all but nonexistent.

Workers in the hospitality industry are suffering an unemployment rate nearly four times the national average. At the peak of the pandemic, 90% of hotels laid off or furloughed staff, at the cost of 7.5 million jobs. Four in ten hotel employees are still not working.

Cities across the country are also feeling the pinch. Hotel occupancy taxes are major revenue sources for municipal budgets. With urban hotel properties continuing to report occupancy rates down 50% over this time last year, cities are dealing significantly reduced tax revenue this year and beyond. This is particularly bad news for destination organizations, which continue to rely on occupancy taxes for a majority of their funding.

While occupancy numbers have ticked up through the summer, the forecast for the remainder of the year remains grim. Only 38% of Americans report that they intend to do any traveling by the end of the year. Tourism Economics and others have warned destination organizations for months that the hospitality sector is unlikely to return to 2019 levels in 2021, and even 2022 is uncertain.

We know Destination organizations will play an important role in driving hotel occupancy back to pre-pandemic levels, but unless they’re able to draw funding from sources beyond occupancy taxes, they’ll have to do so with significantly fewer resources than they had in 2019.