Now is the time to kick your advocacy plan into high gear laying the groundwork explaining why you are essential, absolutely necessary, and very important. You need to make sure you are not seen as a target to fill the coming holes in the budget of many US states.

I grew up watching the television show “Lost in Space.” It was about a space colony family struggling to survive when a spy/accidental stowaway throws their ship hopelessly off course. Given my age (and being the youngest in my family and one of the last kids in my neighborhood), I identified with Will Robinson, the young boy stuck on a planet where everyone is older than you. One of the other key characters was a robot who often hung around with Will and who many times uttered a line that I always remember “Danger, Will Robinson! Danger!”

For this blog post's purposes, however, I am identified as the robot, and you are Will Robinson. But first, let's talk at a very high level about economics and current position of revenues in state governments in the United States. I know what you are thinking but please stick with me. We will get back to Will and the robot.

During my lifetime there have been two dominant economic theories that have shaped the thinking on the strategies behind government spending. Now, no government spending plan that I have seen has adhered strictly to a single theory. Not even close. Instead, policymakers draw on different theories as they see fit, depending on the situation at hand, and may also be influenced by non-economic considerations such as political or social factors or by situations on the ground. An adherence to a single theory is also compromised by the tendency of elected officials to think short term, often just to the next election. But all that said, an economic theory can provide a framework or a direction to head.

The first is an economic theory that was developed by British economist John Maynard Keynes based on ideas that he put forward in the wake of the Great Depression in the 1930s, a time when economies around the world were struggling.

The basic tenets (to the best of my understanding) of Keynesian economics related to government spending are that 1) demand is the primary driver of economic activity, 2) that government spending can stimulate demand (spend more money, say on public works projects, to create jobs and put more money in people's pockets which helps stimulate demand, as people with jobs and income are likely to spend more), 3) therefore government should follow a countercyclical spending policy (government should work against the business cycle by boosting spending during downturns and cutting spending or pay down the debt during upturns), and so 4) deficit spending is acceptable.

The second is an economic theory that was developed by Milton Friedman, an American economist who made significant contributions to the field of economics, especially in the area known as Monetarism.

His views on government spending were quite different from those of Keynes. The basic tenets (again, to the best of my understanding) of Monetarism economics related to government spending are that 1) it is money supply that matters most not aggregate demand, 2) therefore government should have a limited role in managing the economy and, 3) instead there should be a predictable and rule-based monetary policy (Friedman thought that money supply should grow at a steady, predictable rate, rather than the government trying to fine-tune it). Friedman was skeptical of deficit spending fearing it would lead to higher taxes and hurt the economy in the long run.

It is worth noting that despite his general resistance to government intervention, Friedman did support some forms of it under certain circumstances. One of his most famous ideas is the Negative Income Tax, a form of basic income guarantee. Under this system, people earning below a certain amount would receive supplemental pay from the government instead of paying taxes.

So, in essence, Keynesian economics promotes the idea of active government intervention in the economy, particularly through government spending, to manage economic recessions and depressions. It is like a government taking on the role of a driver who speeds up or slows down the car (the economy) based on the road conditions (the economic conditions). Milton Friedman's economic theories stress the importance of free markets, limited government intervention, and stable, predictable monetary policy. Unlike Keynes, he was skeptical of the idea that government spending can effectively manage economic downturns.

I have always been more of a Keynesian guy myself even though a lot of people feel he has been discredited by later theories like Monetarism. In my mind the problem is not with the theory but how it has been put in practice. It seems to me that too often, way too often, policymakers and elected officials always remember the first part of his theory - boosting spending during downturns – and forget the second part of his theory - cutting spending during upturns. Policymakers and elected officials do not like to cut spending, just revenues. Given a choice of paying down debt or cutting taxes, elected official on any given day will pick cutting taxes. That leads to large deficits which will suck up money supply (as government continues to issue debt) that creates the problem that Friedman was trying to address.

What does all this have to do with where we are today? Perhaps not a lot. But it is that scenario of cutting taxes instead of paydown debt and addressing long term financial issues that is creating a warning for tomorrow.

Fueled by surging revenues, states in the United States have been slashing taxes for individuals and businesses for the past three years. Some 25 states have cut individual income tax rates since 2021, according to the right-leaning Tax Foundation. This includes 22 states that reduced their top marginal rates. In 2023 alone, at least eight states approved rate reductions. Aside from individual income tax cuts, states have also lowered the levies on purchases and for businesses over the past three years. Two states cut sales tax rates, while 13 reduced corporate income tax rates and others made additional tax changes that benefited companies.

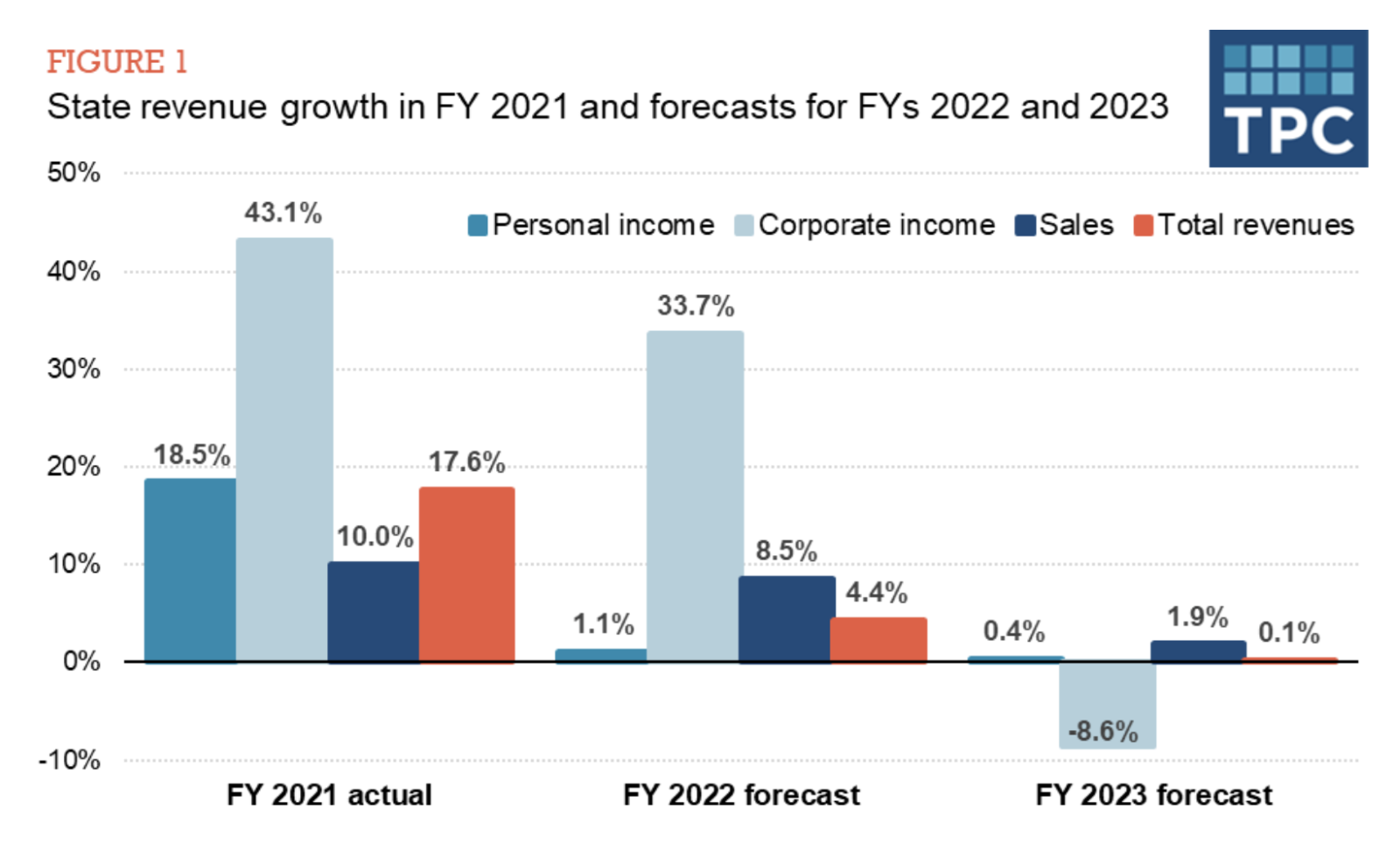

Most U.S. states came out of the pandemic in relatively good economic shape buoyed by stronger than expected tax revenues and “artificially boosted” revenues by federal Covid-19 pandemic relief funds and the strong stock market in 2021. And fiscal year 2023 revenues are coming in stronger than initially expected (the current estimates are outperforming earlier forecasts by 6.5%, according to the National Association of State Budget Officers).

However, according to The Bond Buyer some warning signs are starting to emerge as money flowing into state coffers starts to slow. The tax cuts, along with stock market declines and the shaky economy, have taken their toll on states’ revenues. State tax revenue fell in 37 states, after adjusting for inflation, between July 2022 and May 2023, according to Lucy Dadayan, principal research associate at the nonpartisan Tax Policy Center. Some 19 states saw declines before considering inflation.

Revenue dropped 12% over the period on an inflation-adjusted basis. All major sources of revenue – personal income, sales, and corporate income taxes – declined, though the extent varies widely by state and source. Individual income taxes were the weakest, plummeting more than 22%. States may see some trouble, though there will not be an immediate crisis. Much depends on factors that remain unknown, such as whether the nation will fall into a recession or whether states will face natural disasters.

So, this is the warning. My background includes a four-year stint as an appropriation analyst for the majority staff of the Illinois House of Representatives. That experience taught me a few things about how elected legislators go about their budgeting process. As revenues drop, general state taxes underperform and budgets tighten, legislators will need to cover the cost of programs considered necessary with other revenues. They will target specific tax revenues that minimize political pushback from constituents. Here are some classic options that could potentially minimize this pushback in order of their likelihood to be selected. For the record, the rankings for this list were done by ChatGPT to remove any bias on my part.

- Sin Taxes: These are taxes on goods or activities that are considered harmful or costly to society, such as alcohol, tobacco, and gambling. Increasing taxes on these items can be popular as it can be seen as discouraging harmful behavior while generating revenue. Recent years have seen many states implement or increase taxes on items like sugary drinks or e-cigarettes as well.

- Tourist Taxes: If your state has a significant tourism industry, you might consider a slight increase in hotel occupancy taxes or rental car taxes. This would impact out-of-state visitors instead of residents, although it could have an impact on the tourism industry.

- High-Income Tax Increase: Although this would undoubtedly face opposition from some quarters, it might be less politically contentious if framed as a temporary measure during a fiscal crisis, and if it only affects the very highest income brackets.

- Closing Tax Loopholes: Every tax code has loopholes, some of which may be outdated or not serving their intended purpose. Closing these loopholes could generate revenue and may not be seen as a tax increase by most constituents. However, this could still be contentious depending on the specifics of the loopholes being closed.

- Green Taxes: These are taxes on pollution or other negative environmental externalities. For example, a carbon tax, or increased taxes on gasoline or diesel, could raise money while also promoting environmental sustainability.

- Internet Sales Tax: If your state has not already done so, applying sales tax to online purchases can generate significant revenue. Since many consumers are accustomed to paying sales tax on physical items, this may not be as contentious as some other options.

- Corporate Taxes: Depending on your state's current corporate tax structure, there might be room to increase taxes on larger businesses or those in particularly profitable industries. This could be contentious but may also be popular with some constituents.

Each of these options has its own pros and cons, and what works best will depend heavily on your state's specific circumstances and the preferences of those elected official’s constituents.

So here I go - Danger, Will Robinson! Danger! Consider yourself warned. You have some time before things really kick into action but let me be clear - now is the time to kick your advocacy plan into high gear laying the groundwork explaining why you are essential, necessary, and very important. You need to make sure you are not seen as number two on the list of targets to fill holes in the budget. In fact, you should be working to make sure you are not on the list at all. Remember – you are an investment, not a cost. And most of all, it is time that you really achieve that status of something that is highly valued by the community – a community shared value. If you have dedicated support within your community, policymakers are much less likely to target you.

It is also time to consider attending the Destinations International Advocacy Summit. (This year the summit is part of Fall Learning Week and is comprised of three co-located summits. Be sure to select and purchase your desired session to confirm your attendance.) Among the many topics to be covered is how to build out your own advocacy plan. Whether you need one or it is time to update yours, this will be an important session to help you fight the possible funding battle on the horizon. Registration is open for this year’s event in Little Rock, Arkansas USA.