By Gabriel Seder, Destinations International Foundation

Destinations International has been surveying members weekly through March to keep a pulse on how destination organizations around the world are tackling the unprecedented challenges arising from the continued spread of COVID-19 and the resulting global economic deep freeze.

Last week’s survey results revealed no big surprises. Destination organizations are anticipating massive budget cuts and are busy cutting costs wherever possible. We are seeing painful cuts to personnel costs in the form of furloughs, layoffs, and reductions to employee benefits. And we’re seeing even more drastic reductions in program costs. Destination marketing budgets—already steeply reduced earlier in the month—have been all but put on hold.

Estimating Budget Cuts

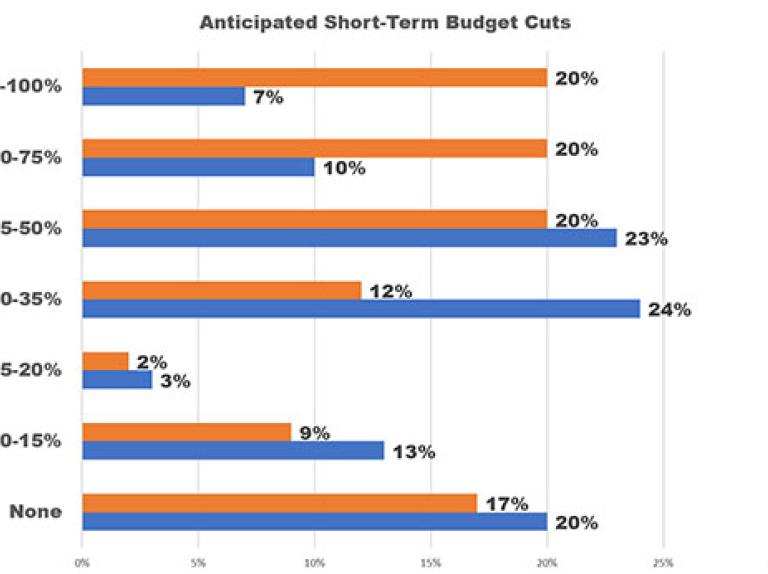

In two surveys one week apart, we asked destination organizations whether they anticipated budget cuts in the immediate future, and if so, by how much. The results show a clear trend of more organizations predicting budget cuts than the week before, and those cuts being deeper than previously estimated.

On March 25, nearly half of respondents predicted that their budgets would be cut by somewhere between 20% and 50%. It turns out that that prediction was probably optimistic; a week later the number of respondents predicting the same level of cut actually went down, while the number of respondents predicting more significant cuts rose.

On March 25, about 15% of respondents anticipated budget cuts greater than 50%. By April 1st, 40% of respondents anticipated budget cuts greater than 50%.

On March 25, only 20% of respondents anticipated no budget cuts at all. By April 1st, that number had reduced slightly to 17%.

Reducing Staff Costs

By March 25th, reductions to staff costs were already underway. More than half of respondents reported cutting professional development costs, 35% reported reducing staff hours, 20% reported furloughing staff, 15% had eliminated positions altogether, and 9% had reduced employee benefits including retirement, healthcare, or other perks.

A week later, we see even more drastic reductions. By April 1st, 75% of respondents had cut professional development expenses, 45% had eliminated positions, 40% had reduced staff hours, 40% had furloughed staff, and 30% had reduced benefits for remaining staff.

Reducing Program Costs

When we began surveying members in mid-March, most had already paused their destination marketing efforts. By March 25, 75% of destination organizations surveyed reported that they had suspended promotions to the leisure marketing and 70% had paused travel trade marketing and meeting or event sales. A week later, just over 80% of respondents reported suspending all three programs.

Going Remote

By April 1st, 84% of respondents had transitioned their offices to fully remote operations, up from 63% the week before. Only 2% of respondents reported that their staff was working in the office under normal hours, down from 10% the week before.

Ranking Priorities

No surprise, when asked to rank their priorities during the last week of March, the majority of respondents ranked “cutting costs in anticipation of steep budget cuts” highest. Respondents reported the following priorities, in order of highest to lowest:

- Cutting costs in anticipation of steep budget cuts

- Being a trusted conduit of information for stakeholders including travelers, residents, meeting planners, partners, members, and staff

- Providing resources to local businesses that are forced to close and to local workers who may lose their jobs.

- Finding reliable information about the pandemic, its implications for the industry, and official guidance for how organizations should react

- Continuing to offer core services and continuing business operations in a safe manner

- Understanding how—and when—to begin recovery planning

Help Us Stay Up to Date

We will continue surveying members weekly and reporting our results. If you work for a destination organization, please take a moment to complete a short survey telling us about your challenges and priorities this week. The survey only takes a minute and helps us continue to be a voice for the industry. Take Industry Pulse Check survey now.