by: Jamie Lane, AirDNA

2021 was a polarizing year for many DMOs, CVBs, and tourism organizations in the United States.

Some locations witnessed an impressive bounce-back from the COVID-19 pandemic. Travelers flocked to drive-to getaways and rural locations off the beaten path. For destination marketers in those locations, 2021 was a year that proved the resilience of the travel industry.

For others — especially those in large cities — urban travel made uninspiring progress. Especially with the onset of two new COVID variants, many destinations scrambled to pivot and position their cities in a new light.

Throughout the year, vacation rental activity has allowed DMOs to track trends every step of the way.

They’ve allowed us to uncover everything from where travelers are staying to where they’re visiting from, how long they’re staying, how much they’re spending, and so much more.

Based on our industry-leading library of over 10 million vacation rentals in 120,000 global markets, we’re extremely excited to announce the 2022 Vacation Rental Outlook Report for Destination Marketers. We’re confident this report will serve as a useful handbook to forecast the future of travel.

A Mixed Year for U.S. Short-term Rentals

In May 2021, AirDNA released its inaugural outlook report predicting the future performance of the short-term rental industry. We made projections on everything from demand to supply, occupancy, nightly rates, location types, COVID-19 recovery, and more.

Before announcing our latest forecasts in the 2022 Outlook Report, it’s worth checking in on how 2021 is wrapping up.

Here’s an update on our 2021 Outlook Report:

- Demand: Our May forecast predicted that demand would rise 27.5% in 2021 over the previous year. While overall demand has been strong, delayed demand recovery for large cities led us to revise our 2021 demand increase forecast down to 22.4%.

- Supply: Surprisingly, overall listing numbers have seen little growth in 2021. Our current expectations of a 2.6% increase in available listings for 2021 fall short of our original forecast of 9.4% for the year. The run-up in single-family home prices this summer, in addition to weak supply trends in urban areas, hindered new investment into the sector.

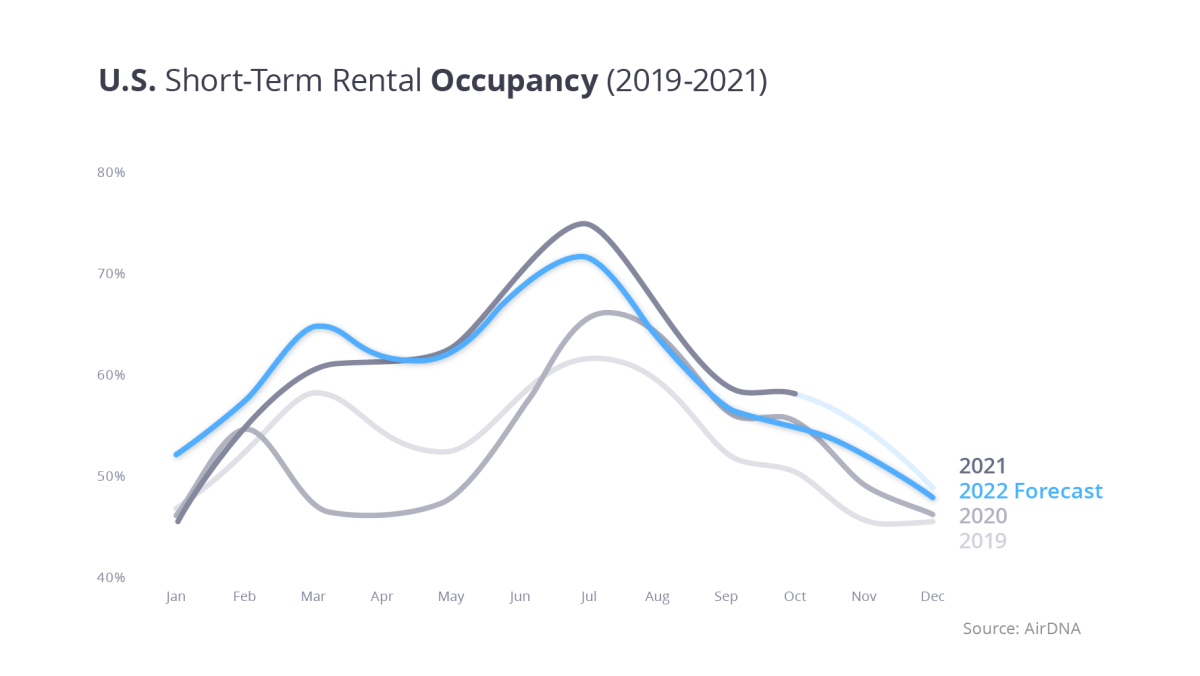

- Occupancy: However, the weaker-than-expected supply growth allowed for higher average occupancy levels for short-term rental operators. Our revised forecast now calls for U.S. occupancy to average 60.3% for the year, slightly higher than the 58.9% forecast in May.

- Average Daily Rates: Higher occupancy and rising price inflation throughout the economy allowed hosts to raise average daily rates (ADRs) even further throughout the last half of 2021. ADRs should end the year up 11.6% — higher than the 9.1% growth rate for 2020.

- Revenue: The combination of higher occupancy and ADR growth has resulted in stronger revenues per listing. On average, listings are expected to earn 26.4% more revenue in 2021 compared with 2020. This is on top of annual growth of 8.6% in 2020.

Promising Economic Outlook Lays Groundwork for STRs in 2022

Typically, the lodging sector has done well when consumers have the means (jobs and income) to travel and feel safe doing so. The COVID-19 pandemic has severely impacted both of these factors, leading to a steep contraction in global travel. However, these obstacles are now fading.

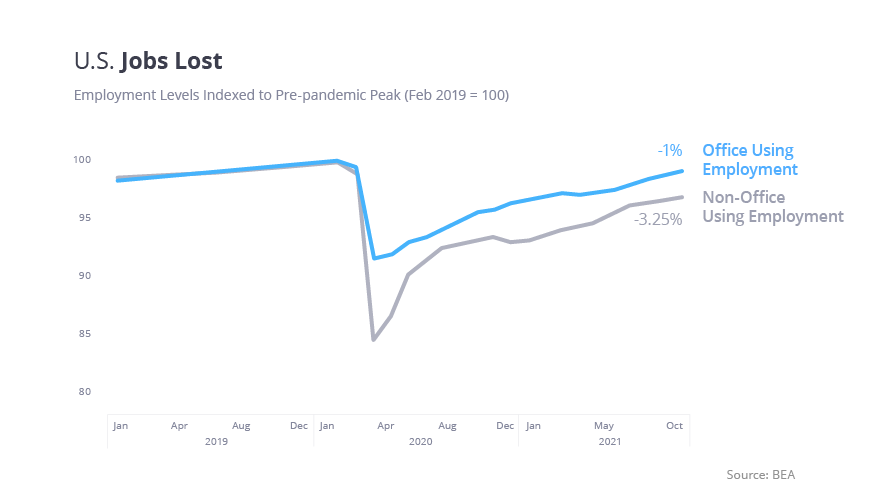

- Overall employment levels are just 2.6% lower than in February 2020. For professions where employees typically work in an office, levels are down just 1%.

- Overall consumer spending has surpassed 2019 levels, helped in part by government stimulus payments. Although the payments have ended, Q3 spending was 4% higher than 2019 levels and rose 7% over the past year.

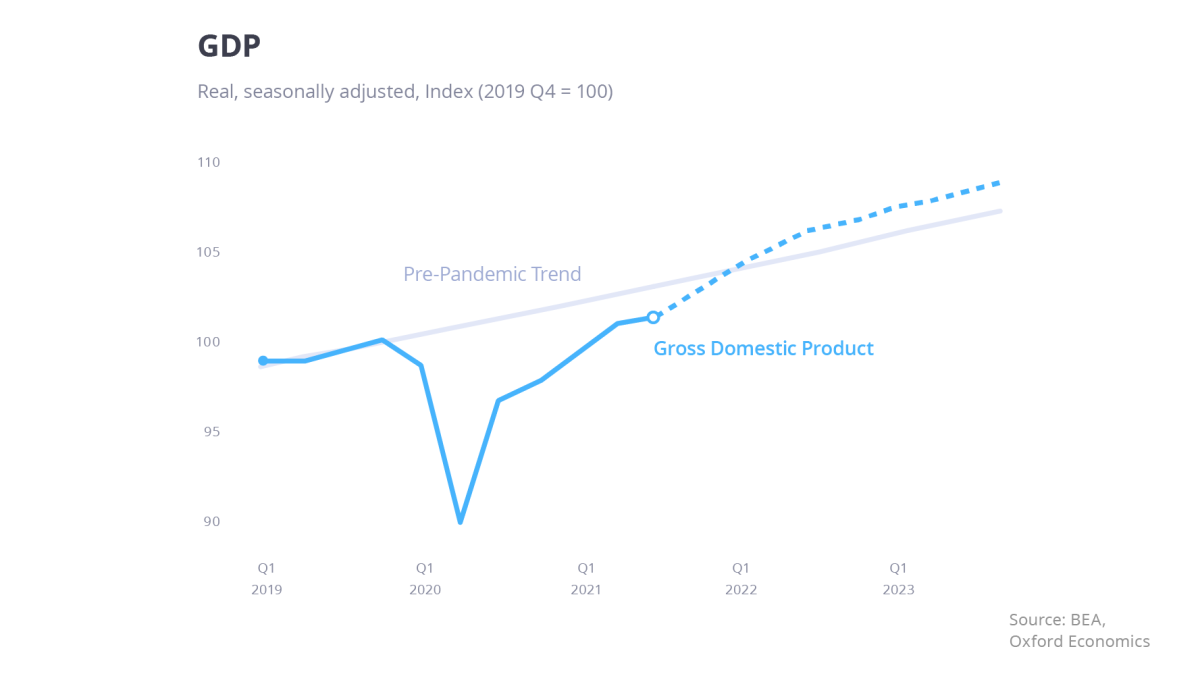

- Gross Domestic Product (GDP) exceeded its previous peak in Q2 2021 and should see strong growth in the year ahead. Oxford Economics expects GDP growth of 5.5% in 2021 and 4.5% in 2022 as labor and capital supply constraints ease.

Travel sentiment stayed positive into November, with 78% of travelers saying they are ready to travel, according to Destination Analysts. Longwoods International reports that 89% of travelers have plans to travel in the next six months. As news of the Omicron variant emerges, willingness to travel could wane. In August, as news of the Delta variant made headlines, the number of travelers indicating a willingness to travel fell by 10%.

AirDNA’s 2022 Vacation Rental Industry Outlook

The table below outlines our predictions for the short-term rental industry in 2022. Predictions are based on AirDNA’s industry-leading library of over 10 million vacation rentals in 120,000 global markets, along with third-party data on economic performance.

Here are some of the major takeaways:

- While the stage is set for demand to fully recover by the end of 2021 (2.6% higher than 2019), we expect demand to grow another 14.1% in 2022 over 2021 levels.

- With the number of available listings still 9% below 2019 levels and existing properties essentially full during peak travel periods, demand growth will hinge on more supply coming online to accommodate more travelers or higher occupancy of existing listings.

- Occupancy is set to continue its strong trend in 2021, with an average rate of 59.8% in 2022.

- Average daily rates will decrease by 4% due to changing seasonality patterns and increased supply.

- Revenue per available listing will settle down due to the influx of new operators and decreased nightly rates.

Urban Demand Getting Back on Track

Starting in 2022, demand growth will be highest in large cities as their recovery catches up to other areas.

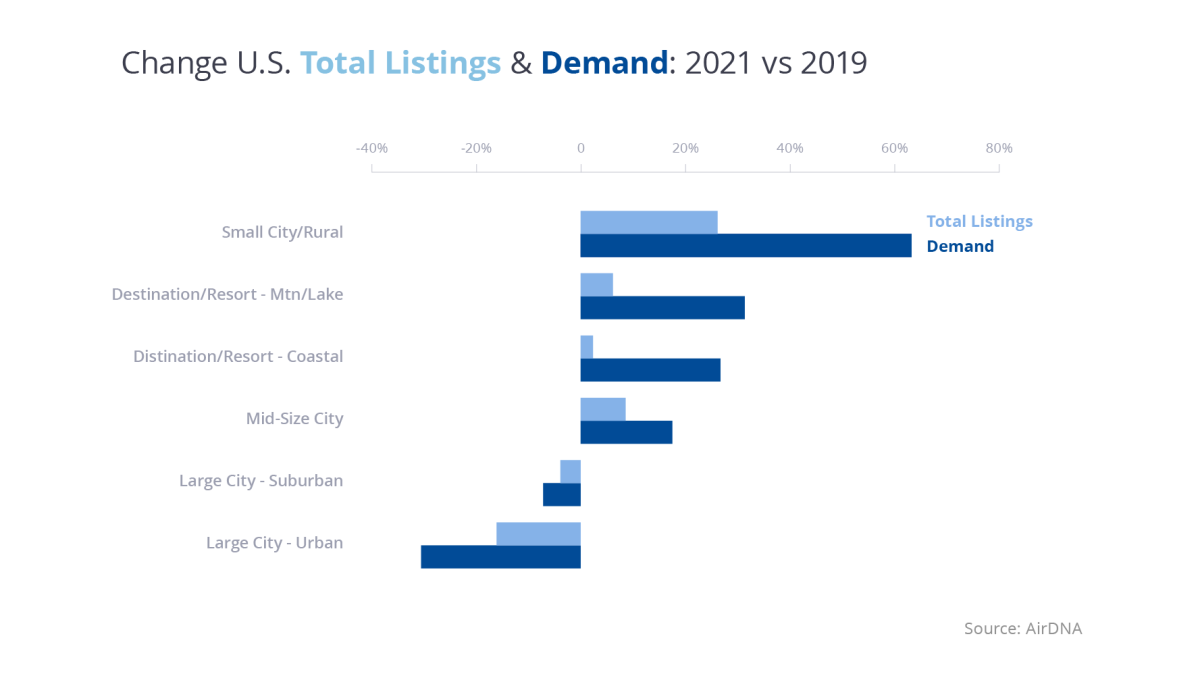

As we’ve reported since the beginning of the pandemic, urban areas experienced the largest decline in demand in 2020 (-43%), and this continued in 2021, with an increase of only 8.5% over 2020’s already depressed levels. This leaves urban areas with 38% fewer nights stayed in 2021 than in 2019.

In 2022, however, we expect that demand will grow by 33%, ending the year 17% below 2019. It will probably be 2023 before urban areas fully recover demand, with some cities — like New York, Boston, and San Francisco — taking even longer.

When Peak Season Doubles: Expanded Seasonality for Many U.S. Cities

2021 became known as the year of the “never-ending” summer. Many of the most popular destinations for short-term rentals reached peak season months earlier than normal — and that peak extended further into the fall than ever before.

Remote work has undoubtedly given workers added flexibility, and this has helped spread peak demand over more months. It is still hard to say whether that demand is sustainable.

Coastal and mountain/lake destinations are likely to see the biggest negative impact from changing travel patterns, but that impact isn’t expected to start showing up until the back half of 2022. Overall demand for properties in coastal destinations is expected to grow by just 3% in 2022.

The Nightly Rate Frenzy is Coming to an End

U.S. ADRs are expected to fall by 4% in 2022, with most of the drop caused by a changing mix of properties being rented in 2022 compared with 2021. For example, demand growth will be strongest in urban markets, where ADRs are lower — $185 ADR in 2021 compared with the U.S. average of $260.

Other factors that may negatively impact ADRs:

- Changing seasonal patterns – Properties where peak season extended into the shoulder seasons may have to reduce pricing as seasonality adjusts to future demand trends.

- New supply – Increased revenue potential should bring new entrants into the market. This additional supply could reduce pricing power, especially during peak periods.

Supply Will Adapt to Capture Shifting Demand

Over the past two years, hosts and investors have adapted to changing demand by removing listings where travelers have yet to return and investing in new homes where demand is greatest. The return of demand to small cities and destination/resort markets throughout the U.S. has led to significant gains in new supply in these areas.

Yet, in the same way that supply chain problems have hindered the global economy, short-term rental supply has been unable to keep up with demand, even with new additions. This has resulted in record occupancy levels throughout 2021. Factors that negatively impacted supply growth in 2021:

- Owner use of second homes to work remotely.

- Strong demand for long-term housing.

- Home price appreciation reducing investment.

In 2022, we expect many of these factors to change and investor interest to surge as demand continues to grow in many areas throughout the U.S.

Overall, AirDNA expects a 15% increase in U.S. listings in 2022 over 2021, with gains spread across large cities and destination/resort markets. Supply growth is expected to be strongest in areas such as the Coachella Valley in California and the Green Mountains in Vermont, where occupancy has jumped more than 30% in 2021.

Flex Work is the Next Big Flex

2021 was the summer of the vaccine, with most Americans getting their first and second COVID-19 shots. With borders opening (for now) and the availability of booster vaccine doses and vaccination for children, the stage is set for the summer of 2022 to revolve around flexible travel.

Worries about COVID-19 variants seem to have curtailed the reopening of many offices throughout the United States. In November, even before the onset of the Omicron variant, VTS reported that demand for office space fell to 39% below 2019 levels, the lowest level seen since the start of 2021. American companies are clearly not planning a major return to offices for 2022.

Even among those returning to the office, only 15% of employers expect to require their employees to work from the office 100% of the time, according to CBRE. More than 60% expect to use a hybrid approach that gives workers flexibility around when and why they work from the office.

Where to Flex?

It’s clear that many Americans will have the flexibility to work anywhere this summer. But where will they go — how long will they stay?

South America

Demand for South America has surged in Q4 2021, and supply here grew the most of any region, up 11% over the past two years. Benefits include a similar time zone as the eastern U.S., low cost of living, and a moderate climate. Top countries for short-term rental supply include Brazil, Colombia, Peru, Chile, and Argentina.

Europe

Europe has traditionally been a top destination for U.S. travelers. In 2019, Americans made more than 36 million trips to Europe, according to the European Travel Commission. In most Western European countries, the U.S. was the no. 1 country of origin for inbound foreign travelers staying in short-term rentals. In 2019, more than 65% of short-term rental stays in Europe were from cross-border travel. That percentage recovered to 50% by the end of 2021, with a significant contribution from American travelers.

United States

Why cross the border when you can have all the benefits of staying at home? U.S. short-term rentals have benefited from growing work flexibility with an influx of long-term stays (trips of more than 28 days). Our data shows that these long-term stays make up more than 15% of bookings — and this percentage has remained steady since the start of the pandemic.

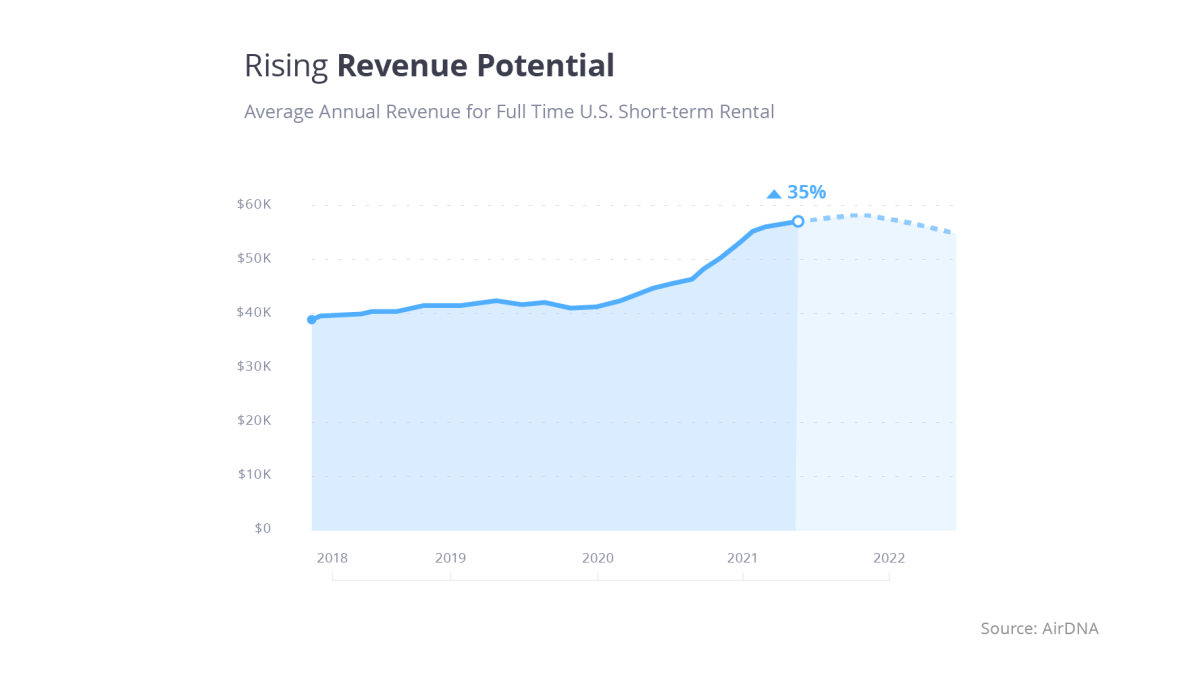

Revenue Potential of Short-term Rentals Rises

The average annual revenue earned by short-term rentals listed full-time grew to $56,000 — its highest level ever — at the end of 2021.

This is a full 35% higher than at the start of the pandemic.

One key thing to note: this growth has outpaced even the meteoric rise in housing prices, which have grown by 24.8% over the same period, according to Zillow. Zillow expects U.S. demand to exceed the supply of available homes in 2022 but for home value appreciation to slow.

With 6.4 million existing homes to close in 2022, there will be many opportunities to invest in high-potential short-term rental markets. The combination of increased supply and weakening ADR growth will lower the overall revenue potential for the U.S. in 2022, with an expected decline of 4.8%. It is expected to stabilize and increase again starting in 2023.

Rising home prices provide an opportunity for capital (home value) appreciation from short-term rental properties, in addition to cash flow earnings.

Travel in 2022: Big Stays and Unique Experiences

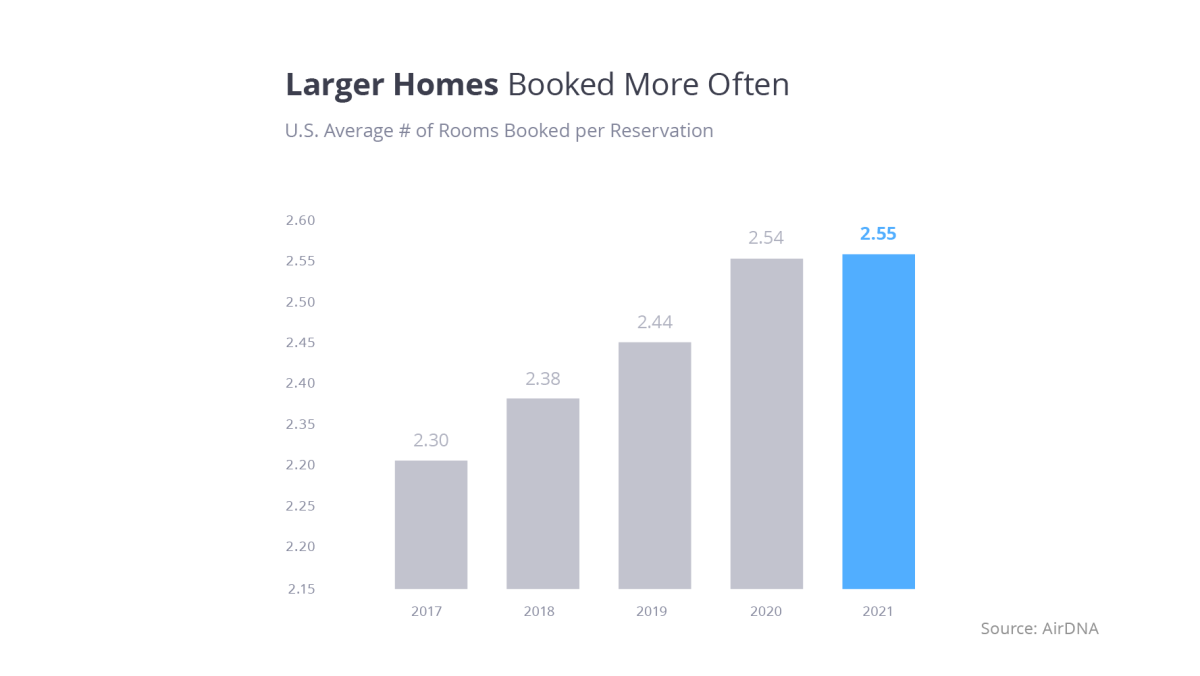

One of the defining trends of the pandemic is the appeal of short-term rentals that accommodate groups and families. In 2021, the average number of rooms for booked properties was 2.55. This figure has grown consistently over the past five years and really jumped in 2020 as guests avoided smaller urban properties in favor of larger homes in destination locations.

In a similar vein, guests today are looking for unique experiences when they book, either for annual family trips or weekend getaways. Tiny houses were the fastest-growing short-term rental property type, growing 27% to 8,402 listings. These were followed by nature lodges, buses, and huts.

Not surprisingly, all 10 of the fastest-growing property types provide unique experiences. Meanwhile, the largest categories of properties — homes and apartments — both saw a decline of more than 5% in listings over the past year.

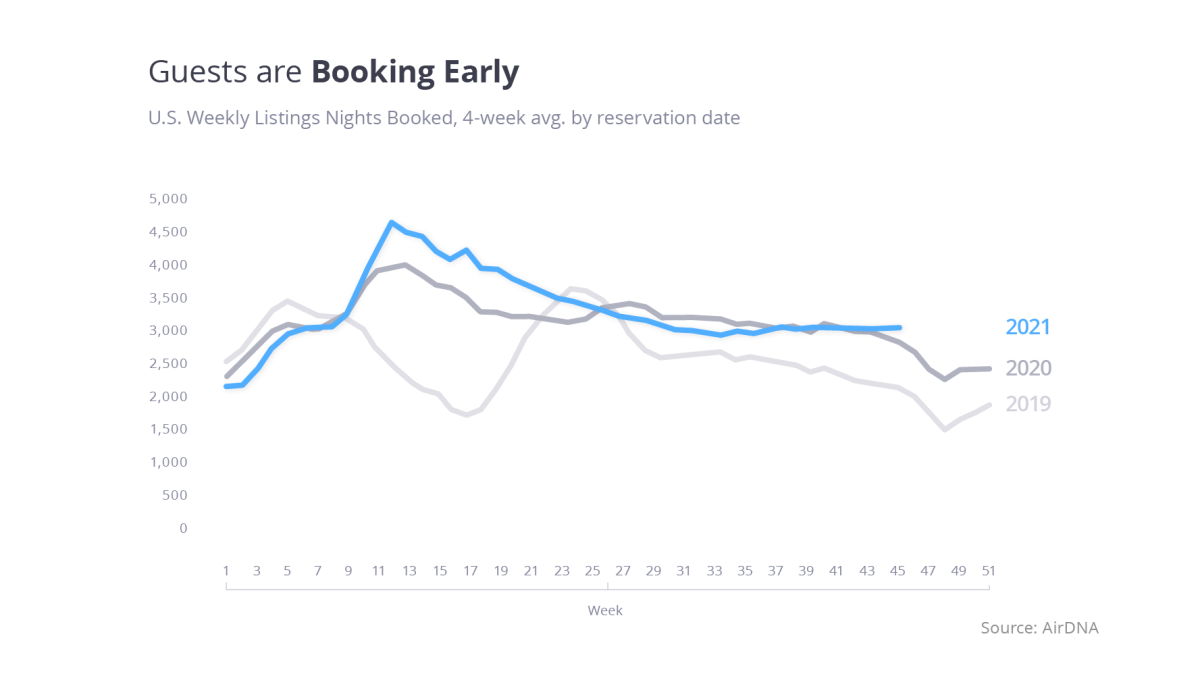

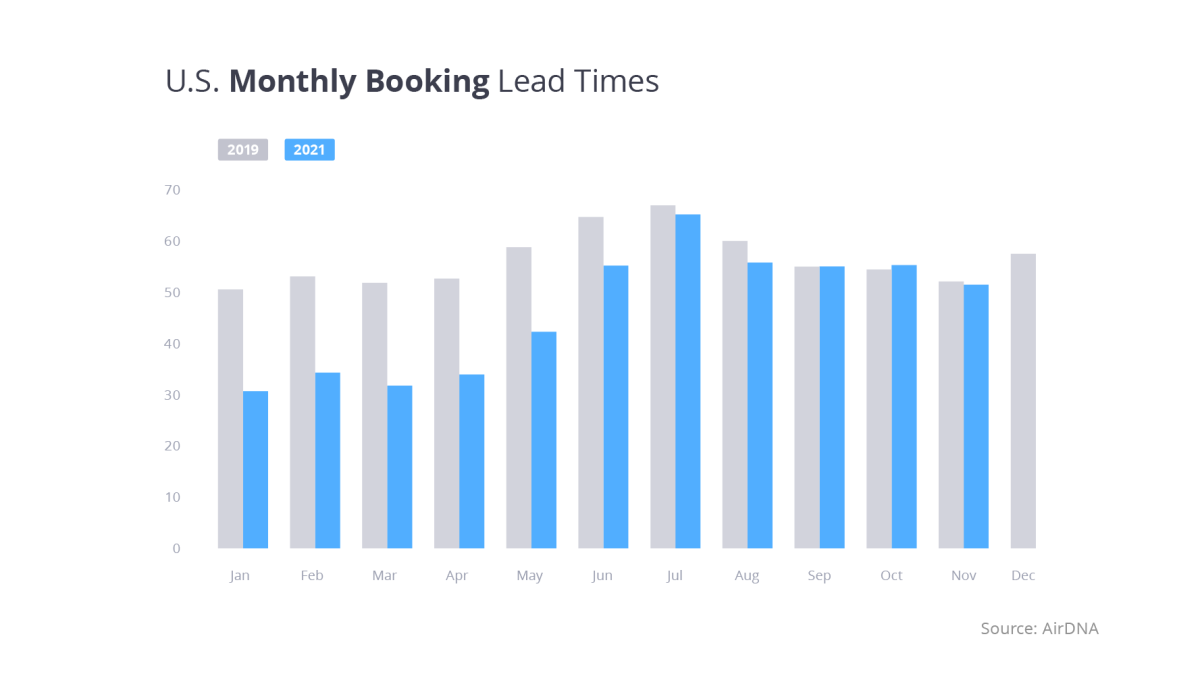

Travelers Are Thinking — and Booking — Ahead

January is the typical start of the U.S. booking season after a slow December. In 2021, that was delayed as COVID-19 cases peaked and guests were unsure of travel restrictions and policies.

As cases dropped in February, there was a surge of new bookings in March as guests rushed to book their summer trips. We reported in our April 2021 U.S. Short-Term Rental Review that Santa Rosa/Rosemary Beach, Panama City (Florida), and Hilton Head (South Carolina) were already more than 80% occupied for June 2021, with an additional seven markets reaching occupancy of more than 75%.

With travelers learning from this year, we expect that guests will plan even further in advance for 2022 to secure top properties in the most desirable locations. According to Vrbo’s 2022 Trend Report, 60% of survey respondents said they plan to book their vacation earlier than they did in pre-pandemic times.

As of Q4 2021, lead times are now exceeding those of 2019, with guests booking 60 days in advance on average. This is a considerable increase from earlier in the year when lead times were averaging around 30 days.

The pandemic has accelerated STRs into the mainstream. Demand is already 10% higher than during the pandemic and the industry is generating 40% more revenue, all with 10% fewer listings. As more investors add supply to capture the growing demand of the industry, it will evolve and adapt to changing consumer trends.

Expect to see more unique properties in off-the-beaten-path locations providing one-of-a-kind experiences that will accommodate guests seeking an alternative to traditional lodging options. While many aspects of the short-term rental market have yet to recover, the whole of the industry should continue to outperform as we head into 2022.